Since the important info of your company changes rarely, you will not have to input this section repetitively. Contractor Invoiceįirst of all, insert your logo and company details and put the date and invoice number manually. In order to have selectable options in the Invoice tab, fill all Payment Details on this page. The contractor invoice also includes payment options.

#FREE INVOICING TEMPLATE UPDATE#

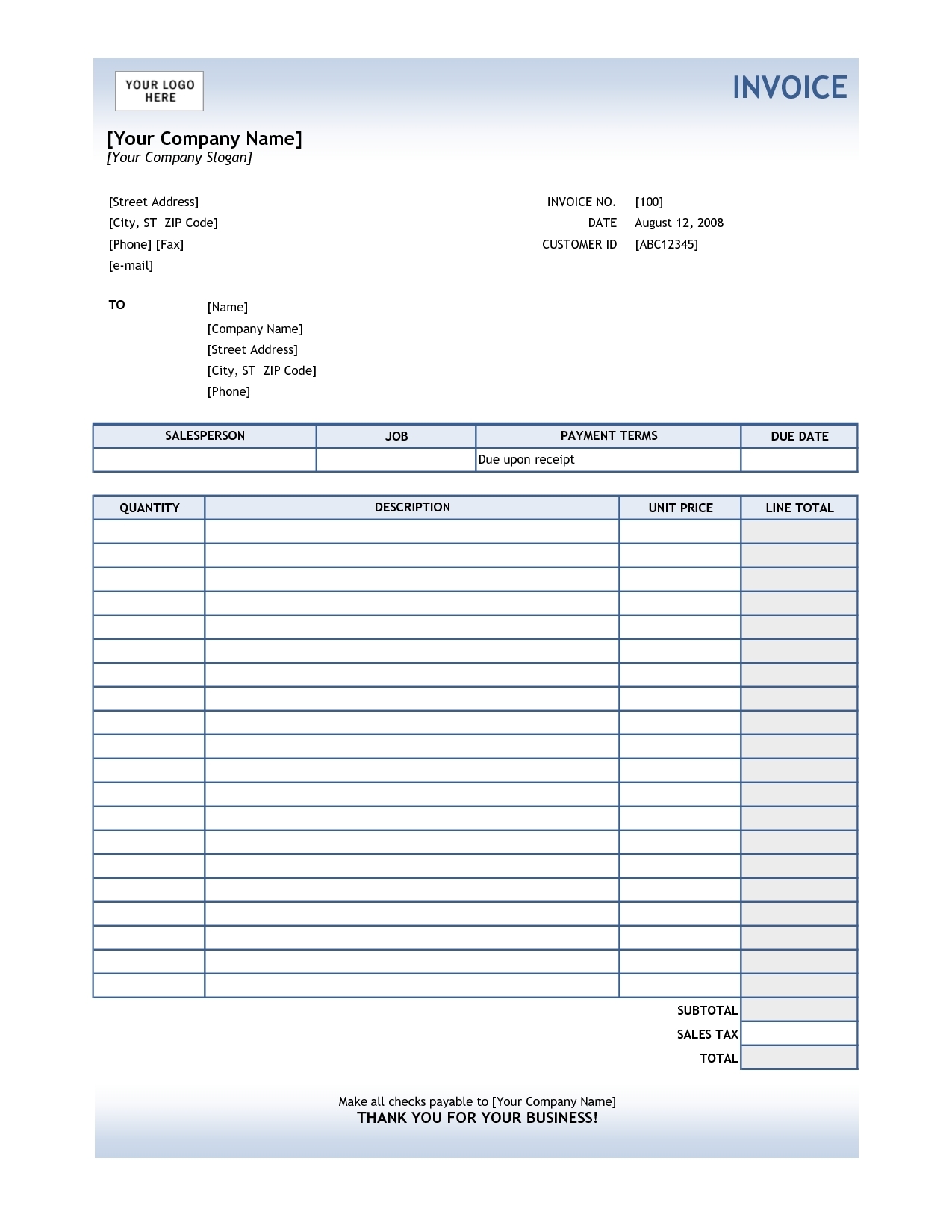

Similarly, you can add all the necessary details here and update them whenever you decide to increase your product base.Īgain in this section contractor invoice template supports up to 200 various materials and labor. The Material and Labor Database has the same logic as the Customer database. You only need to complete this part once and update it whenever you have new customers. The information in this tab will be dynamically connected to Invoice, so fill in carefully and please note that the tool supports up to 200 contacts. In the Customer Database tab, you can add all your customer’s info. Then you will only need to fill in details that can vary from one invoice to another or from one customer to another. You need to complete the Customer, Materials, Labor database, and payment details once you start to use the template. Contractor Invoice Excel Template Features: This tool will help you to set a clear contractor invoice yourself so you don’t keep making any mistakes on paper works. Moreover, it includes a database for Customers, Materials and Labor with a proper layout. This Contractor Invoice Excel Template is for you to prepare your bills in minutes.

#FREE INVOICING TEMPLATE PROFESSIONAL#

Payment options and details (e.g.As a company or individual, you always seek to create and issue a professional document for the services you performed to the client.There are a few more things you can add to an invoice to make them more helpful to customers:

The amount of GST added (for tax invoices).The seller's name (this could be your business or personal name).A brief description of the goods or services you've sold.The words 'invoice' or 'tax invoice' should be somewhere clear on the page.The more information you put on your invoices, the better.

Invoices need very specific information to make sure they're a valid legal document.

Invoices can help you understand your tax obligations and manage your GST credits.īy storing and organising your invoices – both the ones you send to customers and any that you get from suppliers – you'll get a clearer idea of how much GST you need to pay and if you qualify for any GST credits. Including your time on invoices also helps to set expectations with your customers so that they know how time factors into the cost and what to expect in the future.

By including how long it takes to source, build or provide your products and services on your invoices, you can keep a track of what you spend your time doing – and then set your prices to reflect that. Invoices can help you track your time and set your prices. They can also flag financial challenges and help you prepare for them, like when sales drop or when customers aren't paying on time. Invoices can show you patterns in your sales so you can see when people are buying certain products, and what products are selling best. They also help manage your cash flow, track your time and understand your tax. Invoices are more than just a way for your customers to pay you.

0 kommentar(er)

0 kommentar(er)